Accounting

College of Business - Accounting

website LinkAbout US

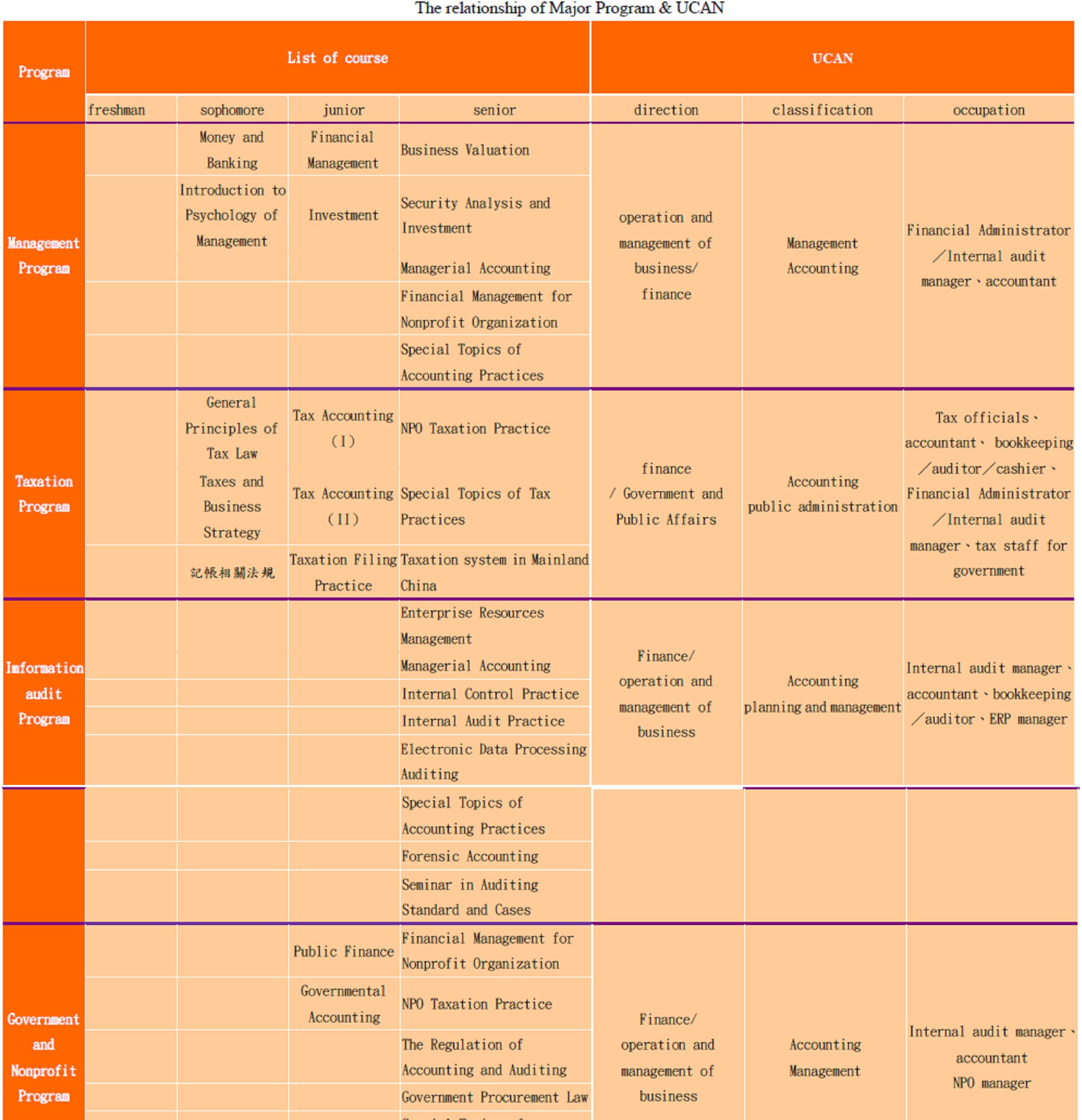

The design of the curriculum emphasizes a balance between theory and practice in order to implement the concept of holistic education. The main curriculum includes specialized courses in accounting, required courses, and general education courses. The curriculum also integrates courses in four specialized areas including management, accounting for government and non-profit organizations, tax law, and information auditing. The design aims to develop a healthy personality, professional ethics, and international perspectives to prepare students to become first-rate accounting professionals and researchers. With the intention of raising students’ competitiveness in the job market, the department also offers seven professional tracks including accountant, Internal auditor, Stock analyst, Accredited bookkeeper, Public official (in areas such as accounting, auditing, and tax law administration).

Master’s Program and EMBA Program

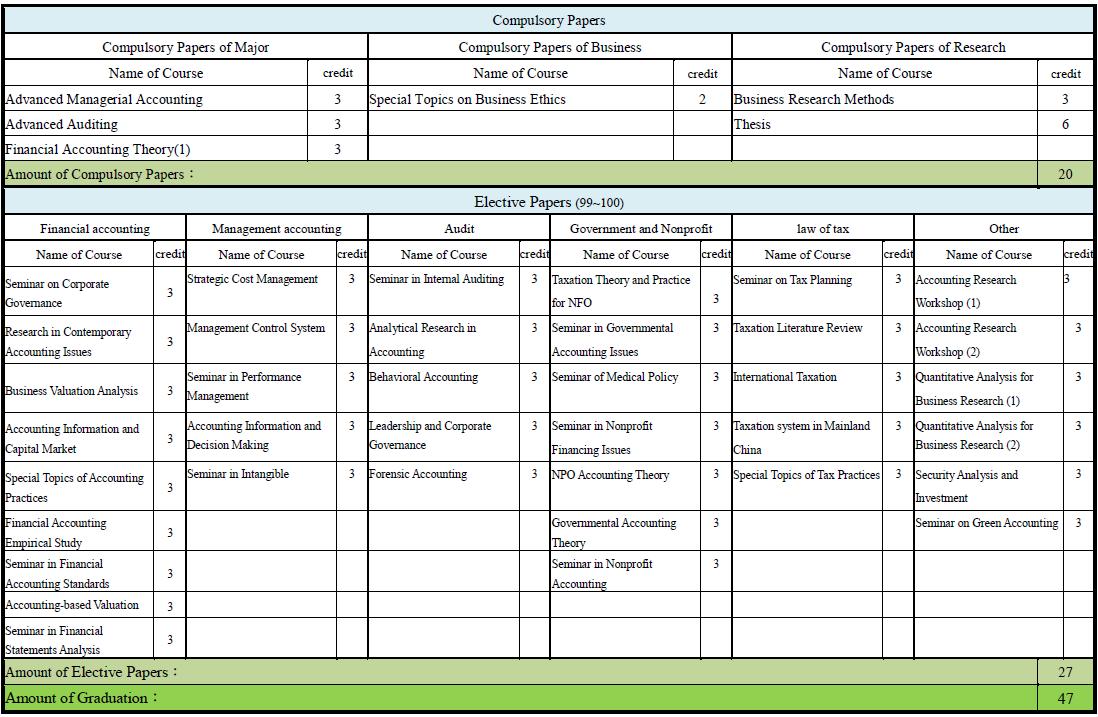

The required courses in the master’s program include Financial Accounting Theory, Advanced Managerial Accounting, Advanced Auditing, Research Methods, Thesis Writing, Special Topics on Business Ethics, and etc. In order to meet with practical demands, the department also offers curriculum in the areas of financial accounting, managerial accounting, auditing, accounting for government and non-profit organizations, tax law, and others.

International Exchange Activities

Short-Term Internship

Objective

The purpose of the program is to develop accounting students into accounting professionals that are efficient in theory and practice. Through short-term internship opportunities, students would observe, learn, and practice in the work place outside of the classroom setting so as to prove what they have learned. This would develop students’ future employment competitiveness and adaptability in the work setting.

Description

Internship period: Summer of every year

Application eligibility: Accounting juniors going into the senior year

and graduate students in accounting

Application time: Application is open every year

Internship organization: The top four accounting firms in the world that have working relationships with the department.

History of the Department

The Department of Accounting was established in 1980. Beginning in 1983, the department started to run two classes per academic year. The night school program was established in 1992. This made the Accounting the second department within the College of Business to have a night school program. The graduate school was established in August of 1997. Accounting talents are the backbone of economic development, key players of business administration, referees for the general public, and participants of government taxation. Accountants are closely linked to the economic development of a nation. Along with the rapid development of the economy and technology, the need for high quality accounting professionals increases as well. The purpose of the establishment of this department is to produce first-class accounting professionals to correspond with the economic developments needs of our nation.

Mission

- Teaching: With growing global business activities and rapid change of the international economic situation, diversity of professional work on both economic and social fronts is increasingly noticeable. As a result, accounting major students are required to master professional expertise and job skills. In order to equip students with various professional capabilities, cultivate their professionalism and enhance their employment competitiveness, the Department has arranged related courses into four programs of “Management”, “Tax Law”, “Information Audit” and “Government and Non-profit Organizations”, since the 2010 academic year. By doing so, the teaching resources from the university and external sources from the related professional fields are integrated to facilitate academic and professional exchange and cooperation with a view to creating a comprehensive learning environment. As to and achieving the consistency in teaching quality, the Department has applied a teaching quality assurance model to its core accounting courses (Principles of Accounting, Intermediate Accounting, Special Topic on Issues in Emerging Accounting, Cost Accounting, Advanced Accounting, Auditing) based on uniform curriculum, teaching materials, teaching progress, question drafting and evaluation since the 2009 academic year.

- Research: Academic research performances of the faculty members of the Department are presented in the following four dimensions: (1) Quantity and quality of the faculty members’ academic researches and professional performances The faculty members of the Department have published a total of 27 papers in SSCI/SCI journals, A-tier international journals in the field of accounting according to the National Science Council (NSC), TSSCI and Taiwan Accounting Review for the past 4 academic years. (2) Participation of faculty members and undergraduate as well as post-graduate students in Taiwan’s academic activities or seminars The faculty members and students of the Department are highly active in taking part in academic conferences, particularly in the annual growth in the presentation of English research papers in seminars. Generally speaking, the faculty members of the Department are very enthusiastic towards academic activities. (3) Subsidies granted to faculty members from industry, government and academic research projects The awards (subsidies) granted to research projects undertaken by the faculty members are mainly from the NSC. Between the 2009 and 2012 academic years, the faculty members of the Department have been awarded with 16 NSC funded research projects. (4) Relevance between the faculty members’ academic researches/professional performances and the needs of social, economic, cultural and technological development. The faculty members of the Department not only devote themselves to academic researches, but also contribute their expertise to the society. For instance, the faculty members serve as members of the review committee of NSC funded research projects, academic journals, seminars or act as commentators (including off-campus speeches) and members of oral examination committee.

- Serving the Society: Professional services provided by the faculty members of the Department are demonstrated in the following four main roles: question drafters and graders in national examinations, editors and reviewers of academic journals, instructors of student clubs and social service providers. With more and more teaching staff holding PhD degrees joining the Department, the faculty members of the Department have played an increasing role of professional service providers. This clearly shows that the faculty members utilize every possible opportunity to participate in academic researches and serve the community whereby they contribute their knowledge to the society.

- Distinguishing Features in Teaching

- Produce accounting professionals that possess the spirit of independence, justice, and selflessness.

- Produce accounting professionals that adhere to the ethics of accounting

- Produce management talents that abide law and order

- Produce management talents that possess the ability to offer professional consultation in accounting and management

- Produce professional talents that are proficient in both theory and practice

- Produce professional talents that can integrate accounting, financial banking, financial law, and information technology

- Enhance the learning environment and its effect

- Promote internationalization

- Provide cooperation between the industry and academia

- Provide continuing education opportunities

- Educational Goals

- Teaching Establish curricula in four different areas including management, tax law, information audit, and accounting for government and non-profit organizations. Develop students’ independent thinking and analytical ability. Develop students’ international perspectives and professional morals in accounting ethics.

- Research Commit to research in accounting and related fields that are in accordance with the current trend and the needs of the country so as to enhance students’ learning efficiency.

- Public Service Provide suitable training and further education opportunities for the general public and personnel from the industry to carry out the concept of lifelong learning.

- Professional Curriculum

The core accounting curriculum covers all aspects of the certified public accountant examination. There are four specialized curricula including management, tax law, information audit, and accounting for government and non-profit organizations. Through the study of the curriculum, students in the accounting program will increase their professional skills in related fields. Students will also acquire related certificates in addition to gaining fundamental knowledge in accounting.

Curriculum >Related Certificates Management - Financial planner

- Stock specialist

- Stock analyst

- Banking related cerfication

Tax Law - Accountant

- Accredited bookkeeper

Information Audit - Business resources planning consultant

- Business resources planning manager

Accounting for Government and Non-Profit Organizations - Accountant

- Public official

- Future Prospects and Employment Opportunities

Direction Potential Track Advanced Studies Pursue graduate studies in accounting to absorb more refined knowledge or pursue graduate studies in other business-related fields to integrate professional knowledge of accounting. Graduate school of accounting

Graduate school of business administration

Graduate school of public finance

Graduate school of financial bankingProfessional Career The department offers seven professional tracks to development students’ competitiveness in the job market:

Accountant track: To prepare students for employment at accounting firms

Internal auditor track: To train students to become auditors in the industry and business.

Stock analyst track: To prepare students for employment at stock companies or investment consulting companies

Accredited bookkeeper track: To prepare students for employment in accounting firms as an accredited bookkeeper

Public official track (in areas such as accounting, auditing, and tax law administration): To prepare students for national civil service examinations or public service in government branchesAccountant/ auditor/stock analyst/accredited bookkeeper/government accountant, auditor, or financial tax administration personnel

Accountants serve as analysts, consultants, and problem-solvers in business and government. Earning an accounting degree opens up a diverse array of career opportunities including: partner in an international accounting or consulting firm, corporate controller, chief financial officer, director of internal auditing, financial planner, or commercial lender. Upward career mobility is outstanding. Compensation is highly competitive with excellent geographic mobility. Students of accounting learn to use and control information technology systems, prepare and analyze financial reports, structure business transactions, and develop effective business plans. Individuals who like being challenged by a variety of situations and technologies and who enjoy identifying, analyzing, and solving problems are well-suited to majoring in accounting.

Future Prospects In response to the internationalization of the accounting principles and the trend of applying for AACSB certification, the Department will formulate its development strategies based on the following directions:

- To design professional courses to meet the industrial needs based on the most recent development of accounting theories and practices both in Taiwan and overseas.

- To organize more academic and practice forums to facilitate the exchanges between the industry, government and academia.

- To strengthen the correspondence with alumni and inherit departmental spirits.

- In concert with information modernization, to continue the construction of accounting information system classroom and to purchase accounting and finance related software and database to support computerized teaching.

- To promote students’ competence in computer information education and application..

- To actively recruit scholars and experts with special expertise and rich experiences as faculty in the Department for the reduction of teaching load.

- To encourage the faculty members to participate in teaching resource production projects and teaching/learning awareness workshops for developing innovative teaching methods.

- To encourage the faculty members involving in industry, government and academia related services, for mastering the development trend of accounting practices and strengthening their cooperation and interactions with all sectors.

- To encourage the faculty members to take part in international academic activities for increment of international exchange opportunities.

A minimum of 128 credits is required for a Bachelor`s degree, including 89 required course credits and 39 elective course credits.

| Professional curriculums | Core courses | Advanced courses | Relevant certification |

| Financial management program |

Financial management |

|

Financial Planning Practitioners

|

| Tax law program | Regulations of taxation |

|

Bookkeepers |

| Information and technology program | Accounting information system |

|

SAP Consultant Certification |

A minimum of 47 credits is required for a Master degree, including 20 required course credits and 27 elective course credits. A thesis is required to qualify for graduation. A minimum of 41 credits is required for the degree of Executive MBA, including 20 required course credits and 21 elective course credits. A thesis is required to qualify for graduation.

| Master program | In-service Master program | |

|

Requisite subjects |

Advanced managerial accounting

Business research methods Advanced auditing Financial accounting theory (I) Special topics on business ethics Dissertation |

Advanced managerial accounting

Business research methods Advanced auditing Financial accounting theory (I) Special topics on business ethics Dissertation |

CURRICULA & CREDITS

FACULTY

CONTACT US

Fax:886-3-2655399